Continuous Online User Authentication in Banking

Customer: Large Bank in the CEE Region

Goal: Decrease the number of fraudulent online banking transactions

and reduce the cost of transaction authorization

Challenge

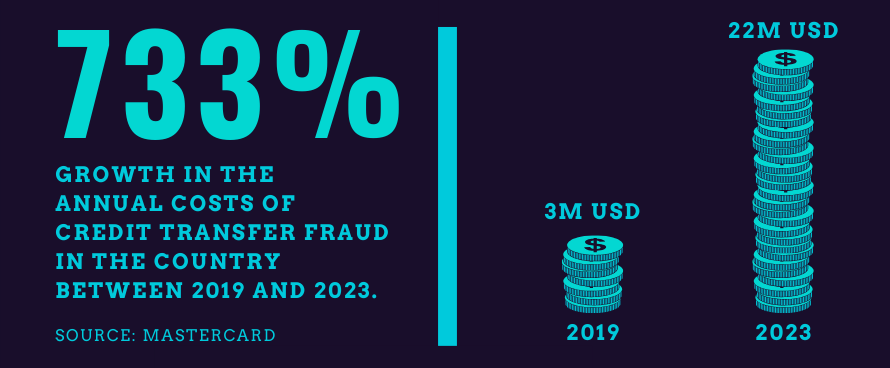

By the first half of 2023, the country's annual incidence of credit transfer fraud exceeded 22 million USD. In 2019, this amount was below 3 million USD; by the latter part of 2020, it only rose to over 4.5 million USD. Additionally, the cost of sending OTPs via SMS has been steadily increasing.

Solution

Graboxy uses movement biometrics to continuously authenticate users. It gathers cursor movement data from the online banking platform through the browser to create identity profiles. If the real-time cursor movement analysis shows a divergence from the user's biometric profile, Graboxy flags the suspicious user sessions. Flagged users can be locked out or re-verified.

How it works

Step 1

The user logs in to the banking account and carries out the usual actions by moving the cursor.

Step 2

Graboxy analyzes the cursor dynamics of the user in real time.

Step 3

By the time the user initiates a transaction, Graboxy authenticates the user.

Authorized user

Silent 2FA completed

Unauthorized user

Request for traditional 2FA

Results

Cost saving on

OTPs via SMS:

-85%

Fraud detection accuracy*:

97%

* Where sufficient training data was available.Authenticated user sessions daily:

100K+

The National Cyber Awards

The Financial Services 2024

Multi-Award-winning cybersecurity platform

built on cutting-edge movement analysis AI by Cursor Insight